About the Client

Top 20 property and casualty carrier in the United States

Challenge

Outdated credit frameworks predicting upcoming financial concerns

Risk analysts and credit professionals are often working with outdated credit frameworks and are faced with the challenge of predicting upcoming financial concerns, a daunting exercise for private companies. Without access to complete and timely company and financial data, assessing a company’s probability and severity of credit risk is an arduous task – especially when required to be done at scale. After all, complex underlying risk dynamics hover beneath the surface, and unraveling them in time requires relying on various early warning signals that need constant monitoring.

Solution

Innovative credit risk solution that offered actionable insights

With private companies reporting their fundamentals at various frequencies and sometimes with large delays, it can be difficult to accurately detect a possible deterioration in creditworthiness. Moody’s provided an innovative credit risk solution that offered actionable insights like: Probability of Default (PD) level, PD Implied Rating, PD change, peer analysis as well as early warning risk quadrants –all helping the client stay one step ahead!

Spot subtle signs of credit deterioration to make informed decisions

Using enhanced early warning alerts, the credit team was able to spot subtle signs of credit deterioration before they become catastrophic problems – resulting in more informed decision making towards effective risk management. Here’s what the client did to identify such important indicators when evaluating public or private companies in their portfolio with limited or no financial information.

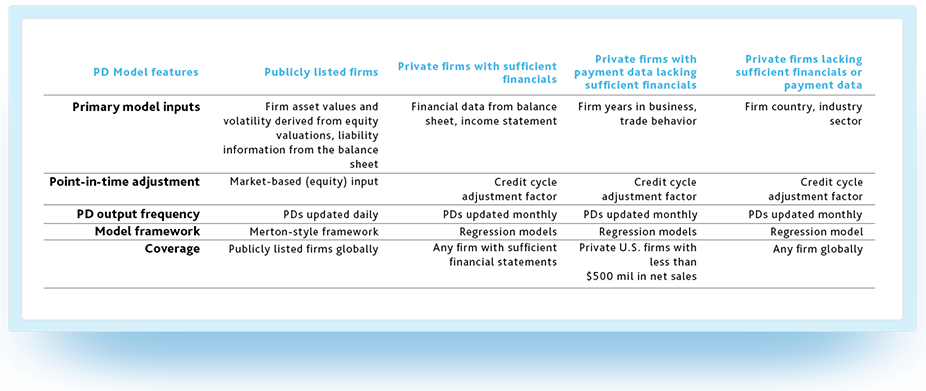

Moody’s Analytics PD models cover an entire corporate credit portfolio

Although Moody’s PD models are derived using different data inputs and different modeling methods, the models all yield forward-looking, point-in-time probabilities of default. They are updated monthly or daily and serve as a solid foundation for early warning of credit risk.

Pre-calculated, point-in-time PDs for 450+ million firms globally

In practice, that means that our Early Warning System can screen for material changes in credit risk for any firm in an automated way, without the need to input data or manually run models.

How it works ?

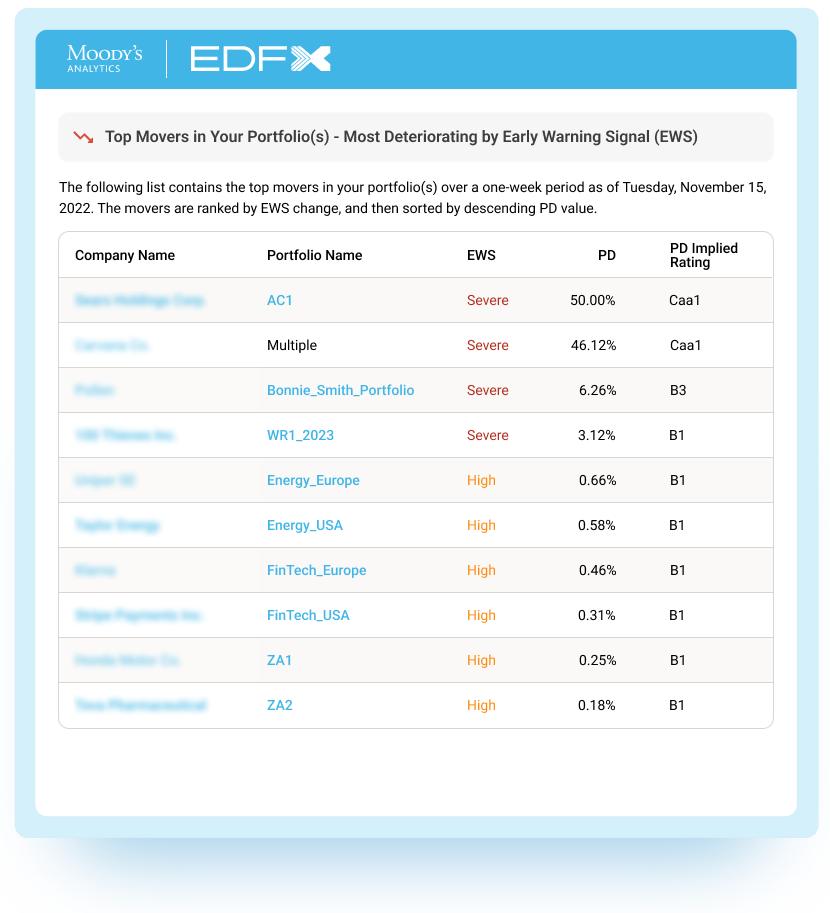

Customized alerts so no risk is left undetected

The client received regular alerts at a customized frequency for their existing portfolio companies and other company names or industries they want to track. These alerts, in a simple and concise manner, show the change in PD levels, PD Implied Ratings and risk category on our Early Warning System for the tracked companies enabling credit teams to take timely action for the identified risk/opportunity.

Key benefits to the client

An automated workflow helped the credit risk team work more efficiently

Impact

Avoided more than $50 million in losses

The client confirmed having a strong forward position on a few trending public and private company names. Moody’s early warning alerts triggered some of these entities in the portfolio showing signs of financial deterioration and transition to high risk category. The client’s credit team connected with Moody’s experts to better understand the severity of these early warning alerts as part of the platform training and confirmed to avoid more than $50 million in losses using our solutions.