Decision analytics are at the helm of EDF-X

With over 50 years of experience in modelling credit risk and award-winning innovations, Moody’s EDF-X takes credit risk signals to the next level by analyzing 520+ million pre-scored companies globally for impending risks, sending a reliable early warning alert, and giving you peace of mind that no exposure was left unturned. It helps you answer: Which of our customers, suppliers, counterparties, or investments are resilient enough to weather the coming storms? Even in the absence of timely financial statement information, EDF-X still produces reliable risk measures leveraging Moody’s curated alternative data, powered by sophisticated machine learning techniques.

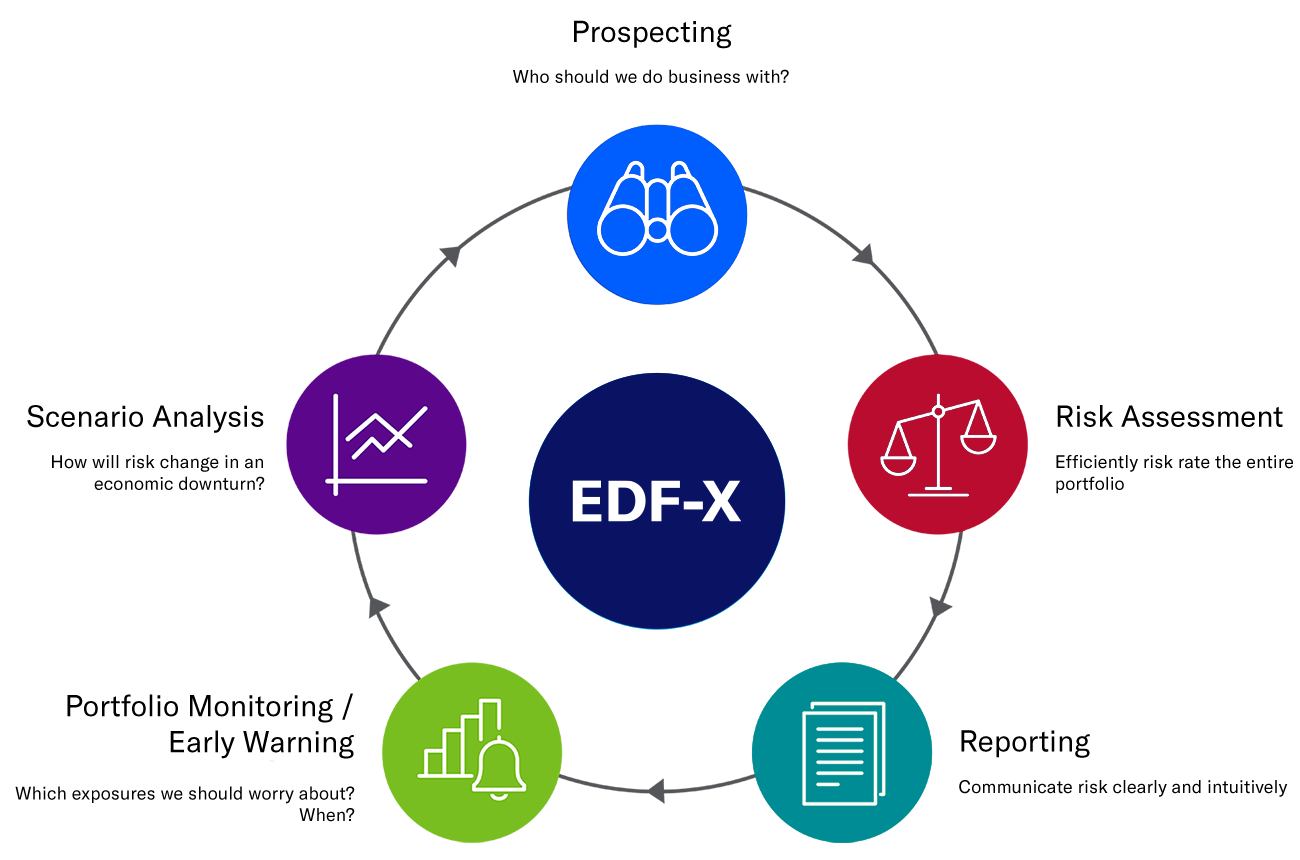

Actionable insights across the entire credit lifecycle

With an intuitive web platform, EDF-X supports a range of credit decisions for financial institutions and corporates by providing Moody’s recommended views, with the option for users to create custom dashboards and incorporate their own data.

Automation and efficiencies for your credit risk monitoring and early warning process

World’s Largest

Credit Database

Actionable

Insights

Early Warning

Alerts

Simple

Execution

Make better, faster decisions with varied views of risk

EDF-X helps solve the fundamental problem of integrating multiple views of credit risks and opportunities into one web platform and API. It helps determine which exposures you should worry about and when.

- Early Warning System

- 300,000+ peer group analytics

- Scenario-conditioned credit metrics

- Drivers of risk assessments & sensitivity to different assumptions

- Dual risk rating (PD & Expected Loss Implied Ratings)

- Loss Given Default, plus instrument pricing

- Climate risk impact

- News-based credit sentiment

- Customized alerts

- Firmographic & ownership details, plus parent-support framework

- Trade payment behavior insights