About the Client

A leading Energy as a Service (EaaS) provider, offering solar panel systems and community solar subscriptions. The company offers clean, affordable energy alternatives to their customer/clients across the United States and its territories.

Challenge

Assessing credit worthiness of dealers and builders

Installation of solar panels is capital-intensive and requires financing for commercial installation products and depend on outside investments in the form of loans and tax equity. They needed help to determine their clients/customers’ credit quality and reliability of cashflows to finance these large-scale installation projects and easily communicate that credit quality assessment to external finance partners and offtakers.

Oftentimes their clients/customers are private middle-market companies without the rating agency ratings or credit risk scores lenders require. Without access to complete and timely company and financial data, assessing a company’s probability and severity of credit risk is an arduous task—especially when required to be done at scale.

Solution

Innovative credit risk solution that offered actionable insights

With private companies reporting their fundamentals at various frequencies and sometimes with large delays, it can be difficult to accurately detect a possible deterioration in creditworthiness. Moody’s provided an innovative credit risk solution that offered actionable insights like: Probability of Default (PD) level, PD Implied Rating, PD change, peer analysis as well as early warning risk quadrants –all helping the client stay one step ahead!

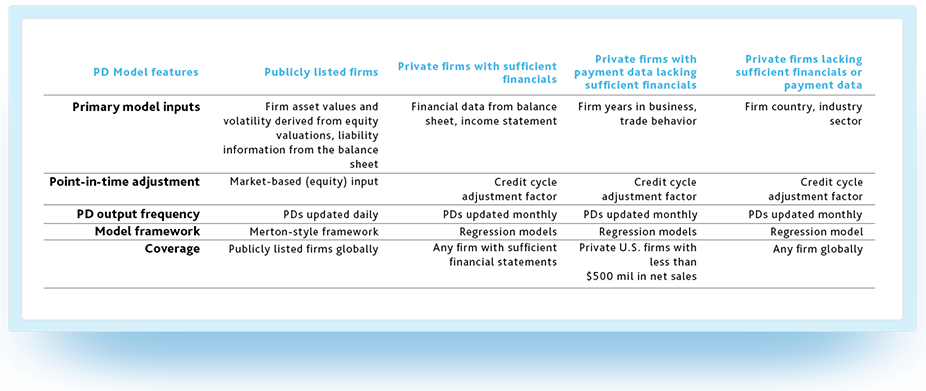

Moody’s Analytics PD models cover an entire corporate credit portfolio

Although Moody’s PD models are derived using different data inputs and different modeling methods, the models all yield forward-looking, point-in-time probabilities of default. They are updated monthly or daily and serve as a solid foundation for early warning of credit risk.

Pre-calculated, point-in-time PDs for 450+ million firms globally

EDF-X provided our client a clean, consistent risk assessment for public and private companies alike. Since Moody’s rating scale is well known throughout the industry, our implied rating metric unlocked value for the firm by demonstrating where investment grade quality is available for investors. In practice, that means that our Early Warning System can screen for material changes in credit risk for any firm in an automated way, without the need to input data or manually run models.

How it works?

Customized alerts so no risk is left undetected

The client received regular alerts at a customized frequency for their existing portfolio companies and other company names or industries they want to track. These alerts, in a simple and concise manner, show the change in PD levels, PD Implied Ratings and risk category on our Early Warning System for the tracked companies enabling credit teams to take timely action for the identified risk/opportunity.

Key benefits to the client

An automated workflow helped the client work more efficiently

Impact

Implemented best-practice credit assessment and benchmarking tools

The client ultimately gained a risk rating framework with less subjectivity and more consistency and rigor. By benchmarking their clients/customers against a deep dataset of like-for-like default events the firm is better positioned to move credit risk off their balance sheet to interested investors and drive new growth.